Blog

Latest company news and insights – your go-to resource for all things BinaryBeer!

Blog

Easy Production Planning in Brewery with Data

Production planning in brewery can be a challenging task. With

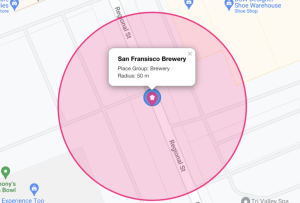

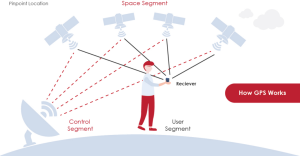

Keg Location Tracking: Why We Don’t Use GPS?

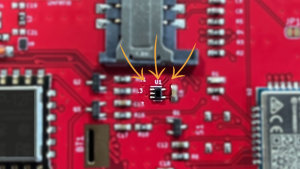

The metrics our KegLink sensors monitor for keg location tracking

Rubber Top & Encased Kegs — Our Next Challenge in Keg Tracking

Some of the world’s best brewers, who are seriously dedicated

How Do We Know if Your Keg is Empty?

Beer Keg Challenges When BinaryBeer first started, one of our

IP69K Achievement Unlocked! Nice 😉

KegLink’s ingress protection rating was officially upgraded from IP67 to

BinaryBeer Launches KegLink 5G Smart Keg Solution for US Market in Partnership with Kegshoe

SYDNEY, NSW, 9th MAY 2023 – Australian IoT innovator BinaryBeer

Asahi Europe & International selects BinaryBeer for international smart keg deployment

Press Release 12th September 2023 In a landmark “Internet of

Protecting Your Kegs: Addressing the Rise in Keg Thefts

The Australian beer industry is currently facing a challenge with